CLIENT PRESENTATION

Presenting solutions is the heart of your role as an agent. It’s your opportunity to align your client’s needs with the right insurance products that offer financial security and peace of mind. Focus on simplifying complex details, highlighting the key benefits, and tailoring each solution to address their unique goals and concerns. By asking thoughtful questions and listening actively, you can emphasize how the proposed solutions provide long-term value and protection for their loved ones. Remember, this is about helping clients make informed decisions, not about selling a product. Build trust, educate, and empower them to take the next step confidently.

💼 Master the Client Presentation

Watch as Brad Smith, Marlin Faulkner, and Debi Junior demonstrate a 9/10 close rate in real-time. This isn’t theory—it’s leadership in action, and a blueprint for success.

How They Close 9 Out of 10

- 1. Build Instant Connection – They lead with energy, ask about the client’s life, and earn trust before diving into solutions.

- 2. Control the Flow – Each presenter guides the conversation intentionally, moving from problem to solution without confusion.

- 3. Create Urgency & Need – They don’t just talk about policies—they frame them around protection, peace of mind, and urgency.

- 4. Use Layered Language – Watch how they reinforce key ideas in different ways so the message sticks.

- 5. Call to Action with Confidence – Their close is direct, confident, and always focused on doing what’s best for the client.

🔥 This video is a masterclass in client communication. Take notes. Watch again. Then go present like a pro.

CLICK TO LEARN ABOUT FINDING THE WHY

Why This Matters

How to Find Their Why

Examples & Tips

Mastering Engagement

Engaging on the Phone

Phone conversations are all about tone, clarity, and authenticity. Establish rapport with these tactics:

- Start with a warm, confident introduction. Example: “Hi, this is [Your Name], I’m following up about the [topic they inquired about].”

- Smile while speaking—it reflects in your tone and creates a positive impression.

- Ask open-ended questions like, “What prompted you to reach out?” or “What are your biggest concerns right now?”

- Practice active listening—acknowledge their responses and repeat key points to show you’re paying attention.

Engaging Online

Online interactions require clarity and professionalism. Use these methods for effective engagement:

- Personalize your messages. Use their name and reference their inquiry to make them feel valued.

- Be concise and professional, but approachable. Example: “I saw you inquired about [topic]. How can I assist you today?”

- Ask direct, open-ended questions like, “What are you hoping to achieve with this coverage?”

- Respond quickly—timeliness shows professionalism and builds trust.

Engaging In Person

Face-to-face meetings allow for deeper connections. Use these strategies to build trust and rapport:

- Begin with a firm handshake and a genuine smile.

- Use body language to show you’re engaged—maintain eye contact and lean in slightly when listening.

- Start by discussing their goals or concerns. Example: “What’s most important to you when considering this coverage?”

- Share relatable stories or examples to connect on a personal level.

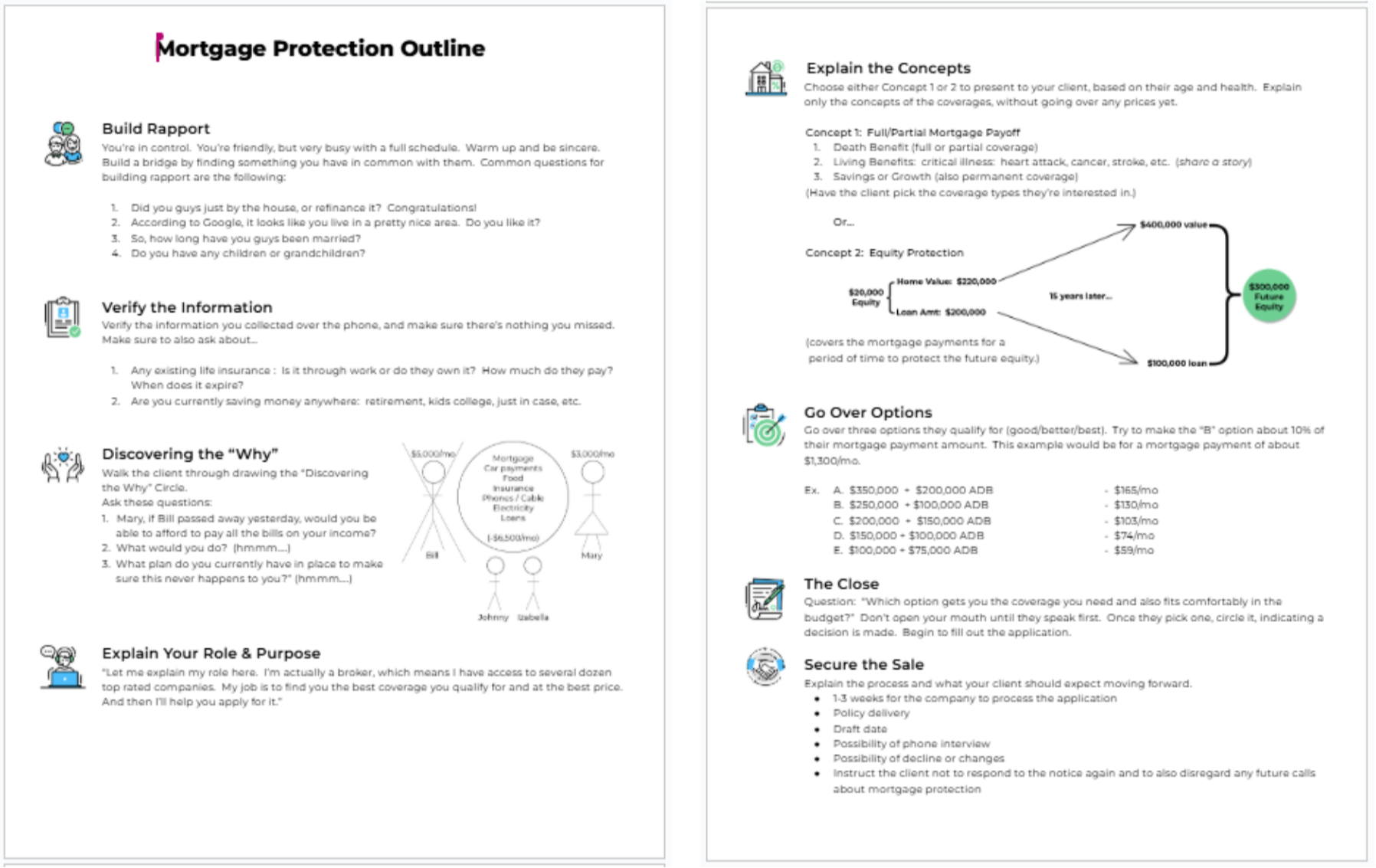

Presenting Full/Partial Mortgage Payoff

Presenting Critical Period Coverage

Overcoming Objections While Presenting

Objections are a natural part of any client presentation. Use the dropdowns below to explore common objections and discover the best ways to address them effectively.