A living trust is a legal document that allows you to place your assets—such as your home, bank accounts, and investments—into a trust while you’re still alive. You remain in control of these assets as the trustee and can change or dissolve the trust at any time. When you pass away, the assets in your living trust are transferred directly to your chosen beneficiaries without going through probate, which saves time, maintains privacy, and can reduce costs. A living trust can also help manage your affairs if you become incapacitated, since your appointed successor trustee can step in to handle things according to your wishes.

ONE FOR ALL AND ALL FOR ONE

Connecting New Beginnings with Proven Expertise

Welcome to Smith Agency, where we Connect New Beginnings with Proven Expertise.

Unlock Your Success with the Right Training & Support

Choose your path below and take your next step toward success!

Live Daily Focus

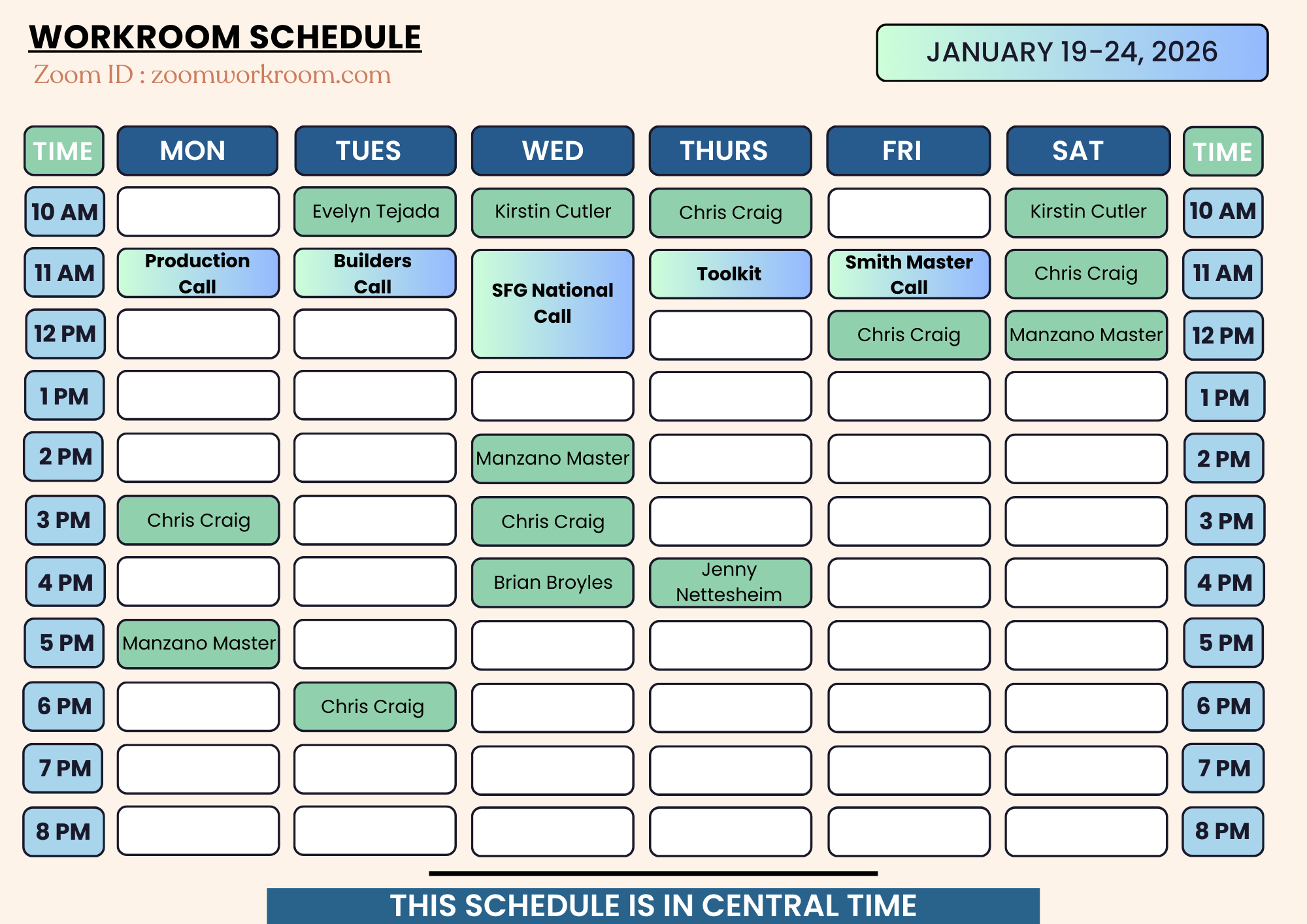

Workroom Schedule

Jump into our daily workroom to dial, train, and stay accountable together in real-time.

Daily Workroom Link

zoomworkroom.com

Weekly Team Webinars

Team Webinar Lineup

Plug into the weekly rhythm of training designed to help you produce, build, and grow.

Webinar Room Link

smithzoom.com

Production Training

Monday · 11:00 AM – 12:00 PM CST

Sales & Field Training

Builders Training

Tuesday · 11:00 AM – 12:00 PM CST

Agency Building

National Training

Wednesday · 11:30 AM – 1:00 PM CST

Corporate & Guest Speakers

Business Growth

Thursday · 11:00 AM – 12:00 PM CST

Leadership & Systems

Smith Master Huddle

Friday · 11:00 AM – 12:00 PM CST

Agency Mastermind

Unlock Your Sales Potential

We’re excited to provide our team with direct access to The Leake Agency’s Sales Mastery Course—a proven training resource designed to sharpen your skills, boost your confidence, and increase your results. This course is packed with practical strategies, real-world examples, and step-by-step guidance that aligns perfectly with how we do business. Many of our agents are already seeing stronger results after applying what they’ve learned. Don’t miss out—dive into Sales Mastery today and level up your growth.

👉 Start the Sales Mastery Course

Mastery Course

Webinar Recordings

Join us live each week for our Master Webinar series at 11:00 AM CST on Monday, Tuesday, Thursday, and Friday. Each day is tailored to a specific focus: Monday is about Production, and Tuesday emphasizes Building. Thursday centers on Development, and Friday concludes with our Smith Master Agency Webinar. Each Wednesday is Corporate's National training call. Don’t miss this opportunity to listen, learn, and engage in real time!

Click Here to View All 2026 RecordingsTeam Leaderboard

We Love To Celebrate Our Team!

We believe in more than just building a successful business — we believe in celebrating the people who make it possible. Our team is the heart of everything we do, and we’re passionate about recognizing their contributions, fostering growth, and creating an environment where everyone feels valued. Whether it’s through milestones, accomplishments, or the daily wins, we’re here to uplift, support, and celebrate every individual who’s part of our journey. Reach out to us — we’d love to connect!

Please note: New Writers are celebrated weekly, please only submit Promotion Increases & Title Changes.

Big Team, Big Impact: Discover the People Who Make It Happen

Seven Teams, One Shared Vision: Leadership Driven by Passion and Perseverance

We are proud to be a family of seven outstanding teams that have achieved the highest levels of success within our company. Each team is led by an exceptional individual whose perseverance, determination, and, above all, deep-rooted passion to make a difference have been the driving force behind their accomplishments.

- Brad Smith

- Nate Auffort

- Marlin Faulkner

- Mike & Jennifer Colburn

- Christopher Clark

- David & Cindy Alvarado

- Josh & Christina Manzano

Perseverance is a common factor of success, the unyielding determination to overcome challenges and push forward, no matter the obstacles. It’s not about avoiding difficulties but embracing them as part of the journey. Coupled with passion, perseverance becomes unstoppable, a driving force that not only propels us forward but ignites the motivation and purpose behind every step.

The Game is On!

Chase the Ace is an exciting performance-driven incentive designed to reward top agents with an all-inclusive luxury experience at Barceló Maya Palace. This exclusive contest challenges agents to achieve key business milestones while earning Ace Cards, each representing a unique accomplishment. The more Ace Cards you collect, the closer you get to unlocking a once-in-a-lifetime trip filled with adventure, relaxation, and elite networking opportunities. Whether you're striving for Gold Level, which includes airfare and VIP perks, or Silver Level, offering an incredible resort stay, Chase the Ace is your chance to turn hard work into an unforgettable reward. Will you rise to the challenge and claim your place among the best? The journey starts now!

See the DetailsWhat Leaders Are Saying...

Testimonials from a few of our Executive Leadership Team

“This company isn't just a business—it's a family. From day one, we are committed to empowering everyone to achieve their fullest potential. The opportunities here are endless, but what truly makes us stand out is our focus on making a real impact. We don't just build careers; we build legacies. I'm proud to lead and be part of this organization.”

- Josh Manzano, 130 Direct

“Leadership here is about more than achieving financial success; it’s about serving others, building relationships, and doing good in the world. The systems we’ve built allow everyone to grow personally and professionally, cultivating a culture of continuous learning and unwavering support.

- Marlin Faulkner, 130 Direct

- David Alvarado, 130 Direct

About

We believe in the relentless pursuit of personal growth and success. By fostering meaningful connections and providing transformative opportunities, we empower individuals to unlock their potential and achieve their dreams.

Vision

Our vision is to be the trusted partner that drives success, ignites passion, and transforms dreams into reality. Through collaboration and innovation, we aim to shape a brighter future where every individual and business can thrive.

Resources

Explore our carefully curated resources designed to support your growth and success. From insightful guides to impactful tools and exclusive opportunities, we provide everything you need to elevate your journey and achieve your goals.

SOCIAL MEDIA

Join Our Community of Insiders

Want to stay updated on our latest events, celebrations, and team news? Follow along and be part of our journey. Stay connected, never miss a beat, and follow us today!

| Click the icons below to visit our pages |

Our Core Values

Relationships matter, people come first

Building strong connections with clients and colleagues is the heart of what we do.

Open, honest, and productive communication

We foster transparency and collaboration to drive meaningful outcomes.

We work as a true team

Together, we create a positive and supportive environment.

Being of service and doing good

Making a difference in the world is at the core of our mission.

Relentless pursuit of personal growth

We constantly strive to improve ourselves and our work.

We do the right thing

Integrity guides every decision we make, even when no one is watching.

We act like owners

Taking responsibility and ownership drives our success.

We have fun and get stuff done

We balance hard work with joy, making every day meaningful.