Resource Library

Corporate Toolkit’s: toolkit.sfglife.com

Symmetry has many tools available to agents to make their job easier, more effective, and more productive. These tools will help with everything from figuring out what products your clients qualify for with the Virtual Mentor, to calling your leads 3x-4x faster with the power dialer, to help you get more referrals with Care-to-Share. You can learn more about these tools at Symmetry’s toolkit page located at toolkit.sfglife.com.

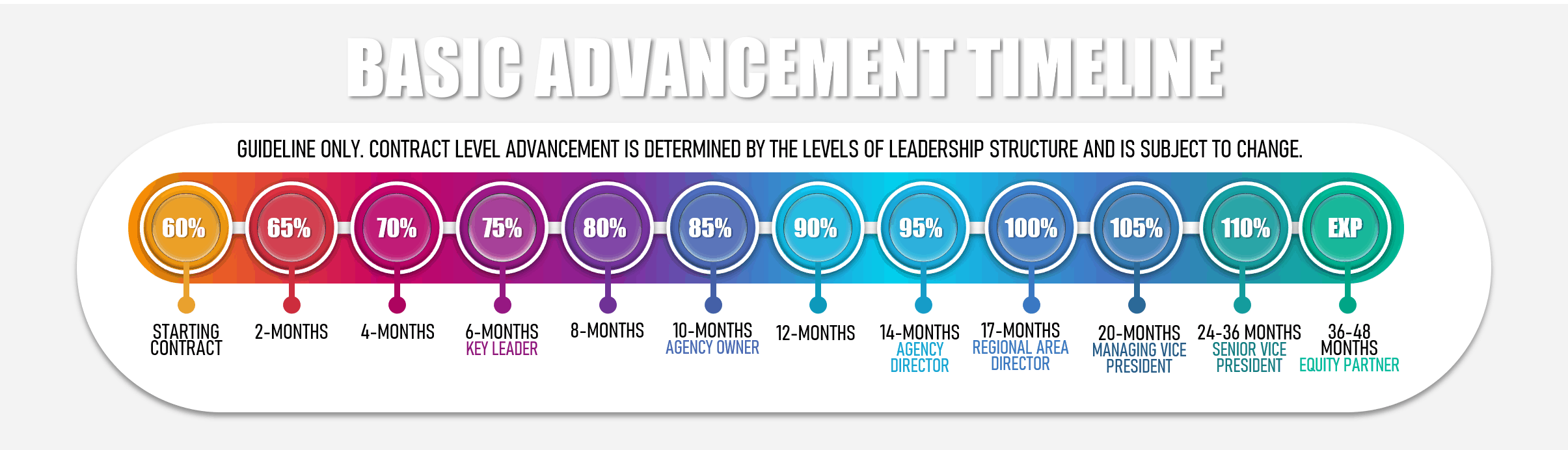

CLICK HERE: Basic Advancement Timeline Download

How do I start advancing?

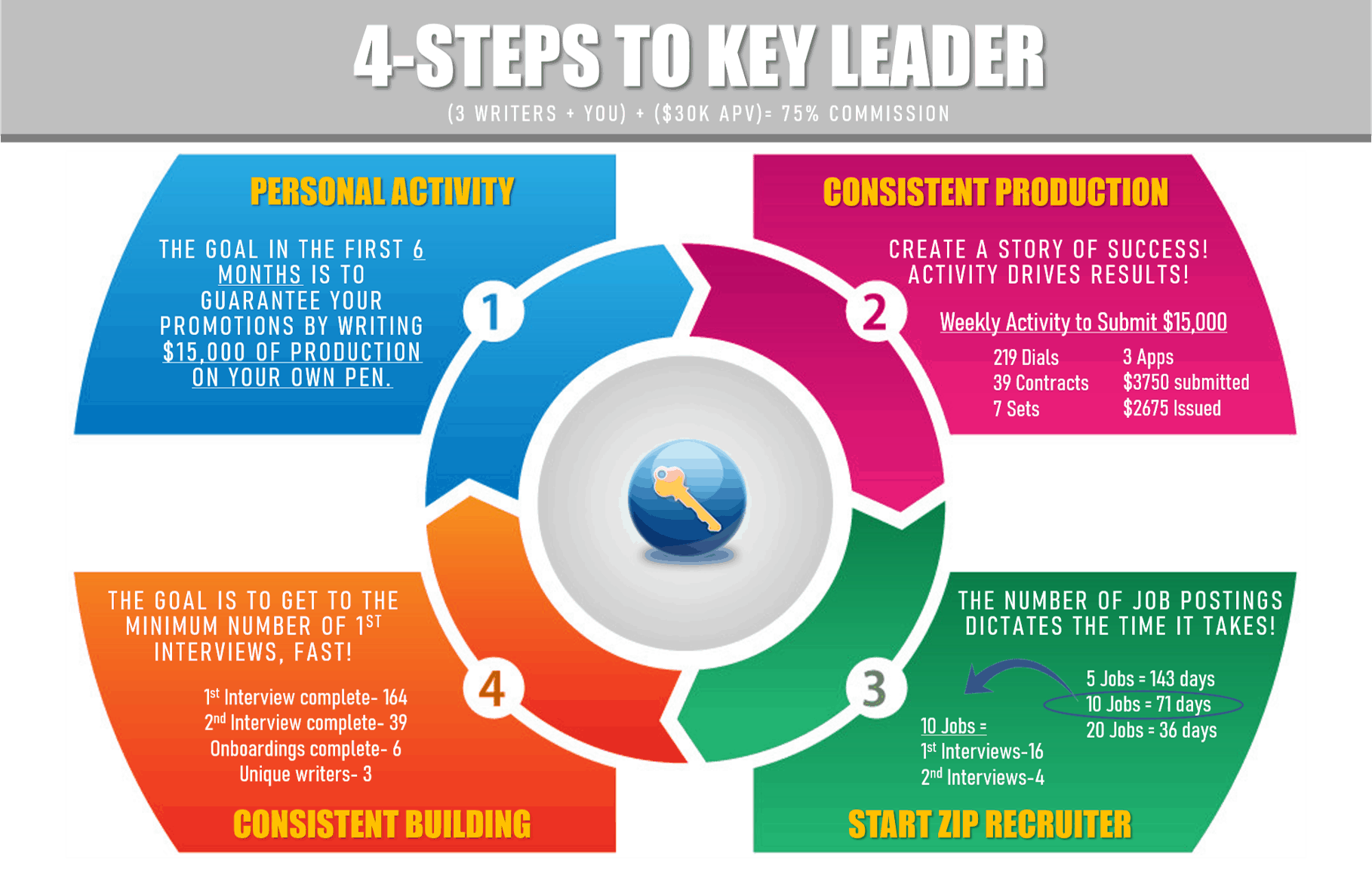

CLICK HERE: 4 Steps to Key Leader Download

How do I maximize my growth potential?

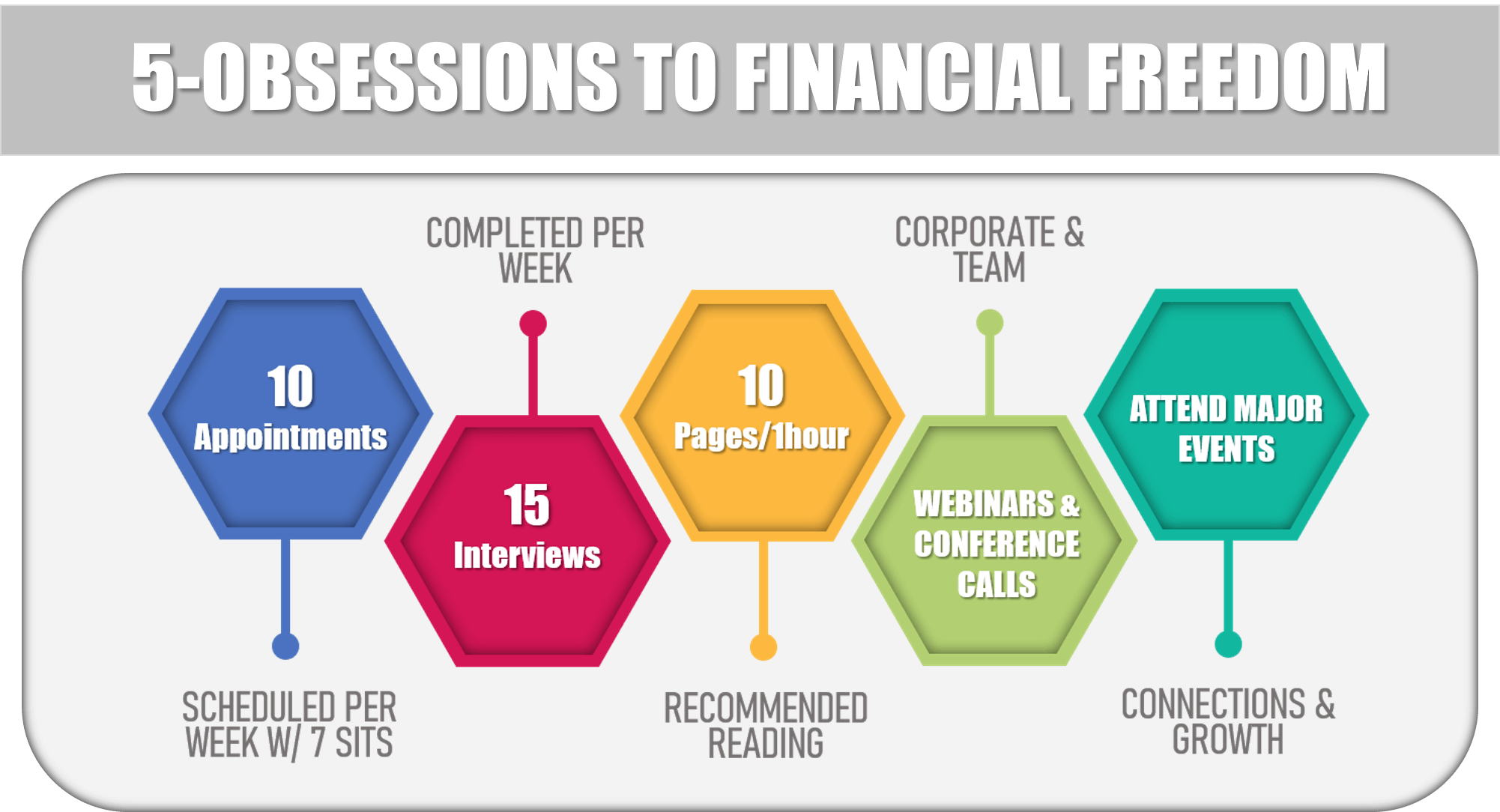

CLICK HERE: 5-Obsessions Download

Having 10 or greater Appointments per week will average to about 7 sits. It’s always a good idea to “stack the deck” by scheduling more appointments than the recommended number. You will need to consistently average 7, knee-to-knee appointments per week. This number should yield at least 5-9 policies in the home.

An important practice of building bridges and establishing relationships is to always deliver your policies. This will give you the opportunity to praise the customer and also discuss other financial planning services. By writing multiple policies in the home, the family begins to trust you and will, in turn, recommend you to their friends (YOU NEED TO ASK FOR REFERRALS).

In order to complete 15 building interviews per week, you will want to schedule 25-30. Our systems are set up to keep in contact with those who “forget” or miss the scheduled interview. We go to great lengths to filter Candidates who are not U.S. citizens, however, some non-U.S. citizens will, in fact, make up local information in order to set the interview. These are common reasons to again, “stack the deck” and keep your interview count as close to 30/week as possible.

By using the form at https://agenttraining.info/crm to result your interviews (good, bad or no-show), the automated systems will move candidates from one process to another with minimal tracking on your part. Candidates receive a series of emails, text messages, and advertising on their social media all linked back to you.

If you are in the habit of reading daily, you are one step ahead of most! If you don’t read daily, you will be now! All top leaders, from our industry and others, are readers. The most effective way to learn is from others who have what you want and have done what it takes to be successful. And the best way to do that is to read and participate in self-development.

Reaching into every aspect of your life and learning why you do what you do can be very overwhelming and frustrating. We have compiled a list of development books that were influential to top income earners. Choose one that interests you or you feel is a need for development in your life. Challenge yourself to read a minimum of 10 pages per day and then reflect throughout the day on those seeds of inspiration. This practice is best done 1 hour prior to your natural wake-up time. This will take dedication at first, but rising 1 hour early each day to dedicate to your own growth, will ensure you are moving towards becoming the greatest you possible.

There are conference calls scheduled each and every week. Because we do business around the country, we have to stay connected remotely. Calls are designed to teach, coach, and train you through our business, as well as keep you up to date on where we are and where we are going.

The best in our industry commit to these calls so we encourage you to do the same. A missed call is the same as an important missed meeting. All conference call schedules are listed on the Agency Pages.

This is where absolute magic happens. Surrounding yourself with like-minded people and building relationships is at the core of our award-winning culture. Major events are put together to foster learning and accelerate growth for those who attend. Being at the event, and inviting others to events around the country, allows those like-minded people to share the path they have taken to success.

Budgeting both time and money around events can be a challenge if you don’t organize and have a plan. Check out our team events page for the latest event happenings. Talk to your Manager about the events you plan to attend prior. Often, there are special rates &/or registrations you will need.

What does it take to succeed at Symmetry? Everyone wants to know the answer to that question. The truth is that “success” is different for everyone. So, it’s important to set a goal that is believable and achievable. Once you set a goal, you’ll create a plan on how you’re going to get the resources and put in the activity to achieve that goal. If you can make a commitment to that activity than we’ll put you in a small coaching and accountability group that you’ll meet with via Zoom every week.

Below is what we call the “Combination To Your Safe”. Only you know how much money you want to unlock… $3,000/mo? $5,000/mo? $10,000/mo? Put in what your GOAL is and what lead type you’ll be calling (talk to you mentor) and it will tell you how many leads you’ll need to get every week and how much activity you’ll need to commit to in order to achieve that goal.

.

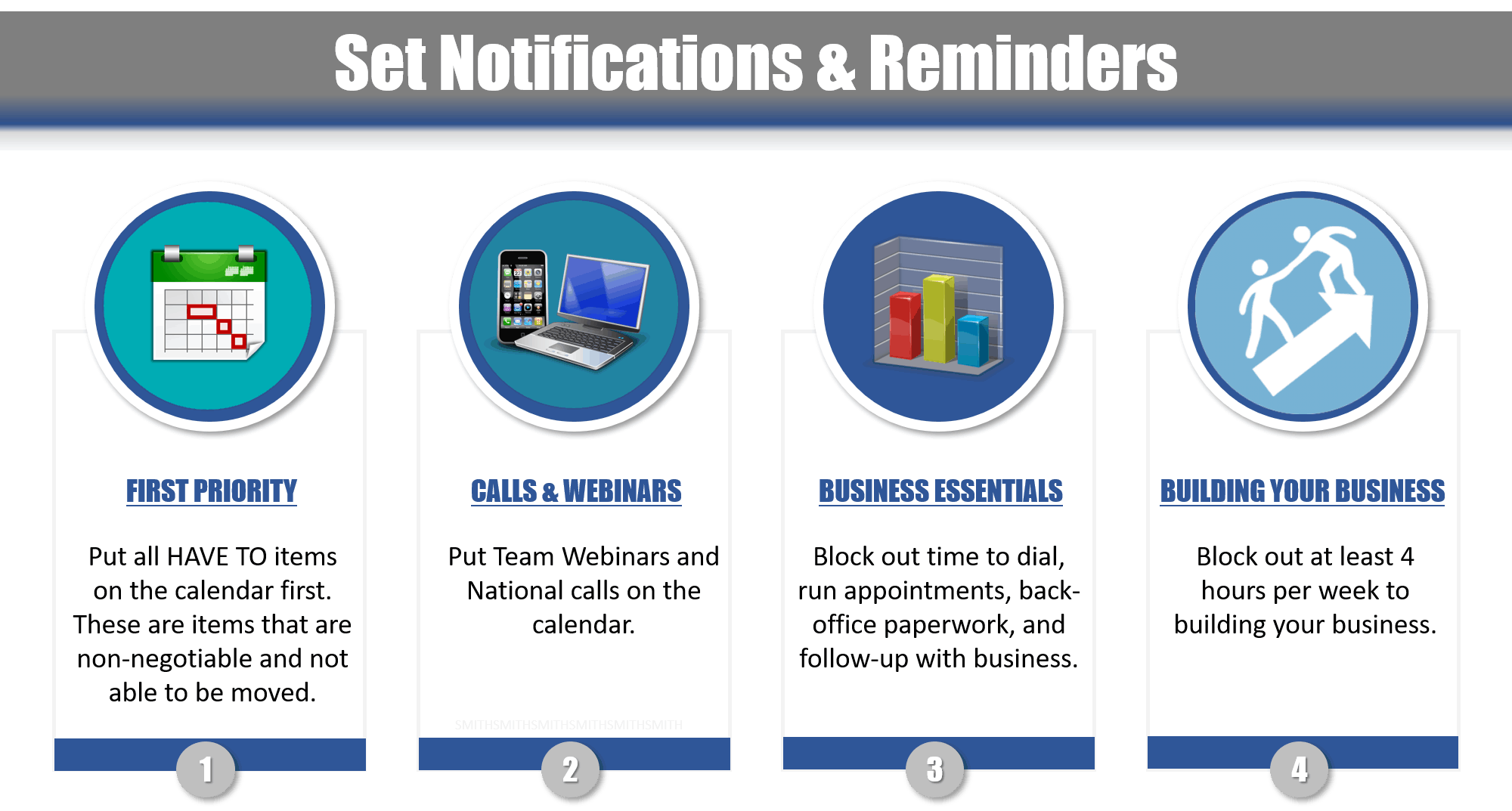

#1 Most important aspect of being successful is the ability to GUARD YOUR SCHEDULE!

What does this mean? This means you must live by your calendar and be intentional with the use of time. You will learn in leadership development more about this topic but for now, its important you understand how to schedule important activities and have systems in place. Learning to only do an activity during its scheduled time is difficult to master but allows for the most productive use of time.

What does it mean to get “Appointed”?

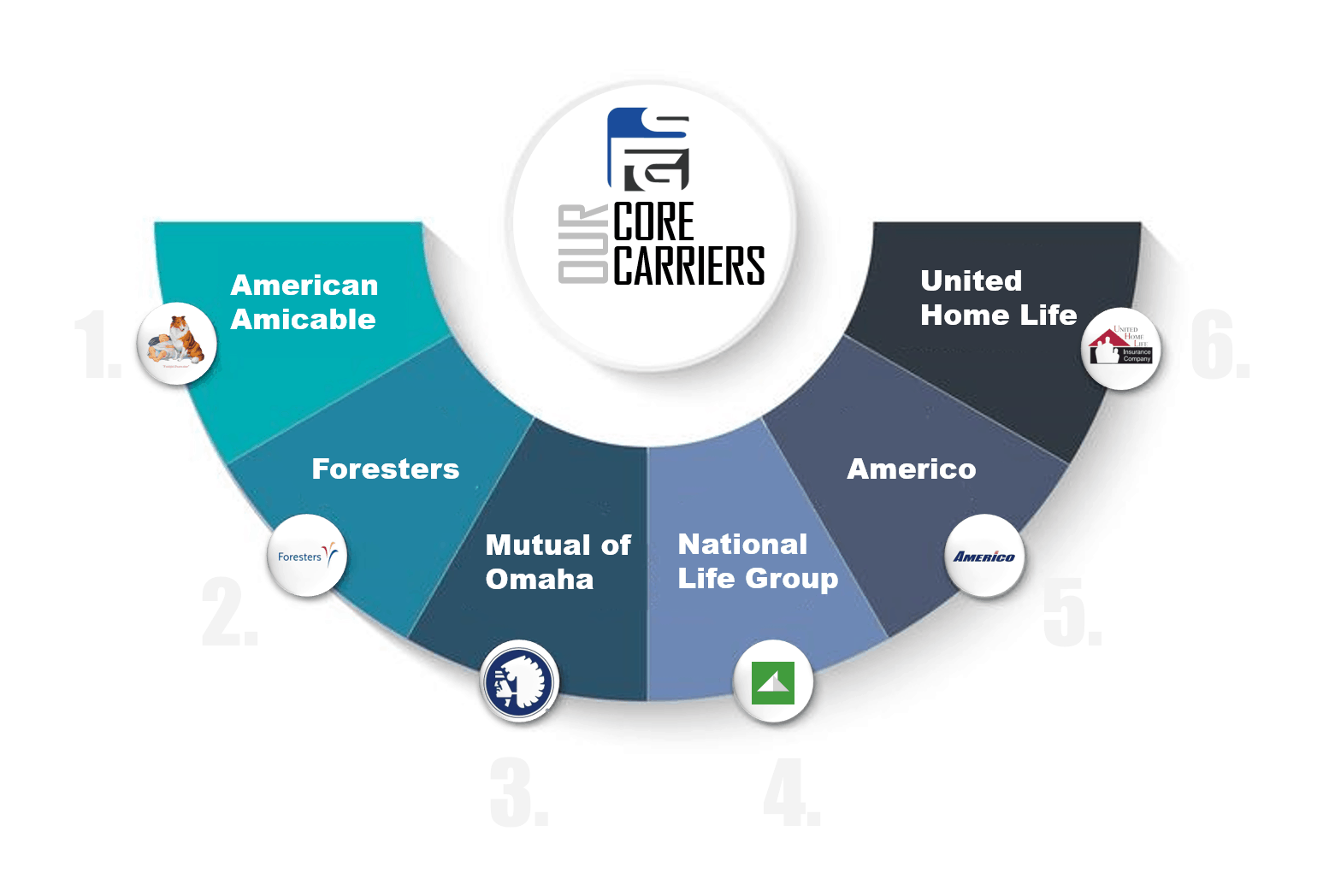

In order to write business with our more than 4+ dozen Carriers, you must be appointed or introduced to them. This is done through the contracting process and the corporate office. Once you have submitted a complete contract, we will hold that information until you write business with the Carrier for the first time. We will then submit the required information to the Carrier on your behalf. The appointing process is only done 1 time per Carrier.

Our core carriers are American Amicable, Foresters, Mutual of Omaha, Americo, National Life Group and United Home Life.

Contracts to these carriers are sent out with a first-time lead purchase. National Life Group is only sent to agents with proof of E&O coverage.

Do I need to do anything to be appointed with the Core Carriers?

We currently write business with more than 3 dozen A++ rated Carriers, including our core carriers, American Amicable, Foresters, Mutual of Omaha, Americo, National Life Group and United Home Life. In order to submit business, you must be appointed with the Carriers.

In an attempt to keep this process simple for you, the corporate office will be handling all of your appointments when you purchase leads for the first time. States that require pre-appointment with Carriers will be handled automatically by the corporate contracting office.

You will receive the following email from our corporate contracting department:

For specific information on each Carrier, visit sfglife.com, login, and choose the Carriers tab.

Lead levels will continue to change as the lead ages. Leads are exclusive to you, but only for a limited time frame. For example, a brand new lead is called an “A Lead” and is exclusively yours for 5 weeks. After 5 weeks, if you have not sold a policy to that lead, it is made available to be purchased by another agent for $6.99. You can continue to call and try to sell that lead, but the other agent will also be calling them. This is a good reason to try to get a resolution on the leads as quickly as you can when you receive them.

- A Lead: Price Depends upon contract level. Exclusive to the agent for 5 weeks.

- 5A Lead: Distributed once as an A lead, but still hasn’t been sold. Now $6.99 each. Starts at 5 weeks of age and can go up to 8 months.

- 4A Lead: Distributed twice. (As an A lead then as a 5A), but still hasn’t been sold. Now $5.99 each. Starts at 10 weeks of age and can go up to 10 months.

- 3A Lead: Distributed up to 3 times. (As an A lead, then as a 5A & a 4A), but still hasn’t been sold. Now $4.99 each. Starts at 15 weeks of age and can go up to 12 Months.

- 2A Lead: Distributed up to 4 times. (As an A lead, 5A, 4A, and 3A Lead), but still hasn’t been sold. Now $3.99 each. Starts at 20 weeks and can go to 18+ months.

- 1A Lead: Distributed up to 5 times. These leads are $1.99 and are between 5 months and 35 months old. These are exclusive to the agent as a 1A lead for 3 months.

- 50C Lead: Distributed up to 6 times. These leads are 50 cents and are between 8 months and 50 months old. These are exclusive to the agent as a 50C lead for 3 months.

A Leads that have never been distributed or bought:

- A Leads: 0-30 Days are regular price, depending upon contract level. See Promotion Guidelines

- Overstock A Leads: 31-60 days old that were never purchased or distributed

- 61-90 days old that were never purchased or distributed

- 90+days old that were never purchased or distributed

Call-In Leads:

- CI (Call In) Leads are a Mortgage A lead and are $14.00 each – when distributed to a standing order, 2 CI leads are considered as 1 A lead. If CI leads are not sold to an agent within 21 days of receipt they roll to the 5a category of bonus leads. Therefore any Call In leads in the 5a and 4a category have never been sold to an agent. If a CI lead is sold to an agent as an A lead it is exclusive to that agent for 5 weeks. If during that 5 weeks a sale is not made on the lead, it is then placed into the 3a category of bonus leads. Once CI leads are introduced to the bonus categories, they follow the same schedule as any other mortgage lead.

- CI2 leads are Call-In leads where the phone number is captured by caller ID. They are $7.00 each.

Lead Schedule & Deadlines

Lead Schedule & Deadlines

- The SFG Lead Department is available during normal business hours: 9am-5pmEST, Monday Friday. For emergencies outside of these normal business hours, please send an email to [email protected]. Inventory changes occur on Thursday at 2 pm EST. The inventory will only show leads that are available to be distributed by close of business on Friday. Bonus leads from our mail house that are not already in the Opt! system, take 24 hours to receive and process for distribution. Therefore, these leads are removed from the inventory at 2 pm on Thursday. This is to prevent agents from seeing leads that will not be available for the weekend. These mail house leads are added back to the inventory on Monday.

- To ensure bonus lead distribution by close of business on Friday, bonus lead orders must be placed by 2 pm EST on Thursday.

- One time A lead orders are due by 1 pm EST on Friday if the agent wishes to receive the leads before the close of business that week.

- Standing A lead orders are filled, charged, and distributed on Friday

- Standing Bonus lead orders are filled, charged, and distributed on Tuesday and Wednesday.

Opt! Inventory

- The A lead inventory viewable in Opt! is a live inventory that shows all A leads currently available for purchase. A leads we have received that are intended to fill existing standing A lead orders are not visible on this inventory

- The leads available on Instant Purchase section of Opt! do not include leads from our mail house. For this reason, the Instant Purchase inventory will always be smaller than the main inventory.

- The bonus inventory is live inventory. Inventory includes bonus leads we currently have available and those that can be ordered from our mail house.

Lead Billing & Payments

- The SFG Lead Department cannot accept lead orders or credit card information over the phone. Paper forms can be submitted via email or orders can be placed online via Opt!.

- SFG accepts Visa, MasterCard, Discover, checks, and cash. SFG is unable to electronically debit checking or savings accounts. Payment must be made for placed orders before leads can be distributed.

Protecting your A-leads/GMR:

Having the ability to have A leads is a privilege with Symmetry Financial Group, NOT a right. When you have a “Geographical Mailing Request” or better known as a GMR, you must maintain a certain number of apps submitted per A leads that are distributed to you in order to not lose them to another agent. This is referred to as your “Close Ratio” or as Marlin Faulkner coined your “Care Ratio”

Your Close/Care Ratio:

In order to protect your A lead order, you need to have a close/care ratio of at least 30%. What does this mean? It means for every 10 A leads that are distributed to you, you must submit at least 3 applications. Now, these 3 applications can come from bonus leads, referrals, apps written on friends and families or from old unresolved leads. It doesn’t matter where they come from, you need at least 3 applications, of any amount of APV, submitted for every 10 A leads that you receive.

Lead Credits

- Credits on leads will be issued on Mortgage & Final Expense A leads only.

- Mortgage A leads with missing phone numbers and leads with both clients over the age of 80 (Mortgage) and age 85 (Final Expense), are automatically given as free leads, so no credits are necessary. Final Expense A leads with missing phone numbers are charged at half price.

- Credits on A leads can be given for: disconnected phone numbers, duplicate leads, leads that fall outside of the targeted geographical area, and non-English speaking leads (in most areas).

- A lead credit must be requested within 30 days of receiving the lead.

Lead Transfers

There may arise a time when a lead needs to be transferred from one agent to another, whether it is an A lead or even a B lead. When this happens there is a very simple protocol that Symmetry needs you to follow in order to transfer that lead.

- Each lead transferred will cost a fee of $5 per lead and will need to be paid by the agent transferring the lead or by the agent accepting the lead/leads.

- Review guidelines on: https://www.simplysfg.com/lead-department

Lead Credits

- Lead credit requests on 3a, 2a, 1a, or 50 cent leads will not be accepted– unless it’s for a duplicate lead.

- Credits on A leads, 5a leads, and 4a leads may be given a credit for the following reasons: disconnected phone numbers, duplicate leads (the first lead received must be less than one year old to count as a duplicate), leads that fall outside of the targeted geographical area, and non-English speaking leads (in most areas). *NOTE* Leads submitted due to a language barrier or bad phone number are subject to investigation to prove the accuracy of the credit reason. Leads submitted for credit due to false reasons will result in earning 1 point on the agents account. The accumulation of 3 points will result in the removal of the agents ability to submit lead credits requests.

- Lead credits must be requested within 30 days of receiving the lead.

- Leads with missing phone numbers and leads with both clients over the age of 80 (Mortgage) and age 85 (Final Expense), are automatically given as free leads, so no credits are necessary. Final Expense A leads with missing phone numbers are charged at half price.

- 3 Strike Policy for Lead Credits – SFG follows up on all leads submitted for credit. Leads submitted for false reasons will result in a strike added to the agents permeant record. The accumulation of 3 strikes will result in removal of the agents ability to submit leads for credit.

For instructions on how to request a lead credit in OPT!, please see the document below:

Good, Better, Best

Once you have determined the best products for your client, you’ll want to put quotes together prior to your appointment. This can be done by simply handwriting them on the back of the lead sheet. When it comes to knowing what prices to put together, a good rule-of-thumb is 10% of the monthly mortgage payment. For example, if the client is paying $1,200/mo for their mortgage, you can expect to get approximately $120/mo for their insurance. This is usually the price you want as your middle (“Better”) option. So your options may look something like this…

Option 1: $120,000 face amount – $160/mo

Option 2: $100,000 face amount – $120/mo

Option 3: $75,000 face amount – $75/mo

This is a basic example, which is a good place to start when you’re just getting started. As you get more comfortable presenting these options, you can add riders to add additional value and premium. For example, if the mortgage is $120,000, but they cannot afford full coverage, you may do $75,000 plus an accidental death rider for $45,000. That way if they die in an accident, they will receive the base $75,000 plus the $45,000 for a total of $120,000. This will save the client money, but make them feel like they’re covering the entire mortgage. These are things that your mentor can help coach you on when you’re going over your appointments with them.

Download a copy of the 5-R’s Here:

CLICK HERE TO LEARN MORE ABOUT REFERRALS

What should I expect?

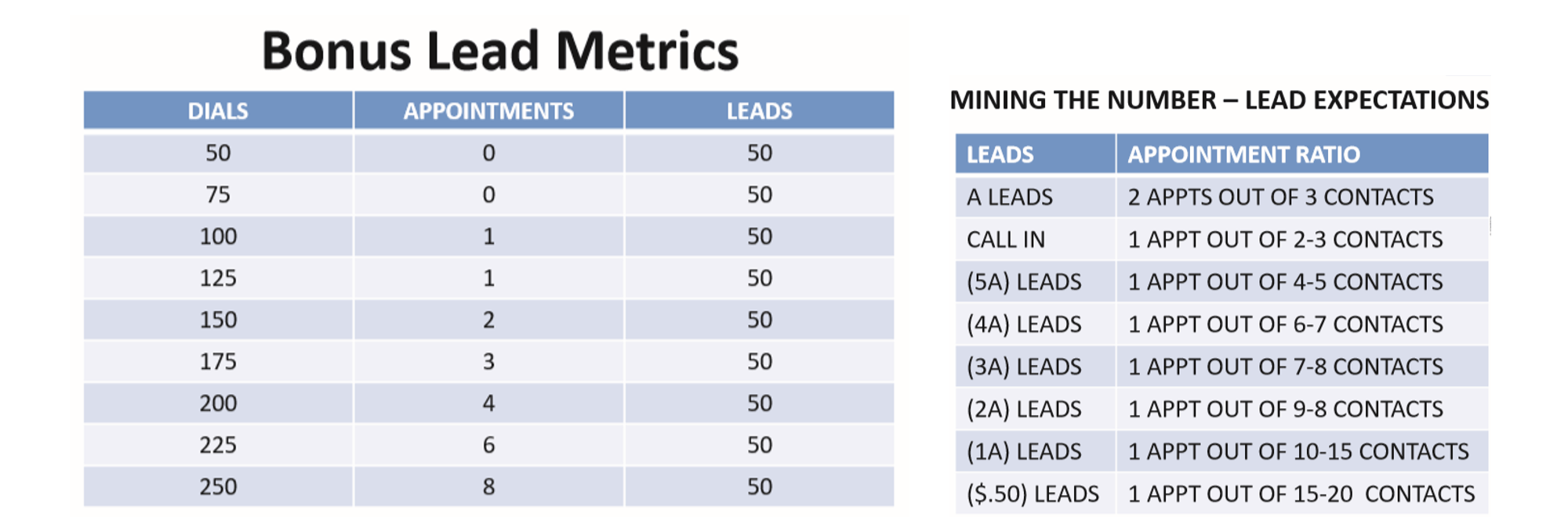

Click HERE to download the Bonus Lead Metrics.

When you’re just getting started, it’s important to understand what to expect when calling and schedule appointments. Keep in mind that you’ll be starting on bonus leads, which is the best way to learn the scripts and get proficient at handling objections and schedule appointments. Bonus leads are older leads and leads that other agents have called, but didn’t write an application on. It’s a numbers game and you’re job is to simply filter the Yes’ from the No’s. You want to get a resolution on every single lead, which means they’ve either told you “Yes, I’m interested” or “No, I’m not interested.” The older the leads are, the more dials you’ll have to make to get your target number of appointments. Remember, always call your mentor after (or during) your calling session to get coaching if you’re not getting the results below.

Learning to overcome objections will make a big difference in your bottom line. It’s uncomfortable at first to “overcoming an objection”. You may feel like your arguing or disagreeing with the person, but it’s important to remember why you’re reaching out to them in the first place.

More often then not, the objection someone gives you on the phone is not a real objection at all. It’s simply a knee jerk reaction. Listen to the training below with tips on how to handle the most common objection people will give you and how to let them know you’re there to help.