Now that you have passed your test, and once you have completed EVERYTHING outlined in "Getting Started" section of this website, you are now ready to accelerate your learning with Symmetry Financial Group, by being guided through a STEP by STEP process to achieve your maximum potential! You will learn the Keys to Success on how an agency was given birth by 3 individuals with NO prior insurance backgrounds, NO in home sales experience, but MORE IMPORTANTLY, over 50 years combined experience in running multi-million dollar businesses, earning millions of dollars themselves.

In a record yet to be matched, learn how Nate Auffort went out his FIRST month in the field and wrote over $50,000 APV (Annual Premium Volume) and over $80,000 APV his first 6 weeks in the business, with over $40,000 direct deposited into his bank account his 1st 2 months, being coached by Matt & Brad Smith, Paul Huneycutt, and Edward Pritchett. Not only was he able to accomplish this outlandish feat, but by plugging people into the SAME system outlined in this section, his agency broke another record by being the FASTEST agency EVER to hit $100,000 APV in only their 5th month and close to $1.5 million APV in just his first year. Because of his accomplishments, He was inducted into the exclusive 'Million Dollar Club" his first year, which takes the average agent in the insurance industry 10 years to accomplish!! Nate Auffort was the # 1 writing agent in all of Symmetry his first 12 months in the business and received the 'Impact Player of the Year Award" his first year, along with both Matt and Brad Smith. His agency nearly doubled his second year in business allowing him and his business partners to create this exclusive 10 Step System, available to only those individuals involved with the SWAT TEAM.

In a record yet to be matched, learn how Nate Auffort went out his FIRST month in the field and wrote over $50,000 APV (Annual Premium Volume) and over $80,000 APV his first 6 weeks in the business, with over $40,000 direct deposited into his bank account his 1st 2 months, being coached by Matt & Brad Smith, Paul Huneycutt, and Edward Pritchett. Not only was he able to accomplish this outlandish feat, but by plugging people into the SAME system outlined in this section, his agency broke another record by being the FASTEST agency EVER to hit $100,000 APV in only their 5th month and close to $1.5 million APV in just his first year. Because of his accomplishments, He was inducted into the exclusive 'Million Dollar Club" his first year, which takes the average agent in the insurance industry 10 years to accomplish!! Nate Auffort was the # 1 writing agent in all of Symmetry his first 12 months in the business and received the 'Impact Player of the Year Award" his first year, along with both Matt and Brad Smith. His agency nearly doubled his second year in business allowing him and his business partners to create this exclusive 10 Step System, available to only those individuals involved with the SWAT TEAM.

His mentors, Agency Directors, Matt and Brad Smith, were also inducted into the elite "Million Dollar Club", and were recognized for running one of the Top 10 Producing Agencies in the entire company, while at the same time Brad Smith was able to be recognized for his personal production by achieving the number 5 Top writing agent with Symmetry, all within their first 18 months. Recently they were awarded the coveted Leadership Award for their outstanding leadership with Symmetry Financial Group and were the fastest agency to ever hit $1,000,000 of APV in one calendar month.

Agency Director, Marlin Faulkner reached the top 10 in Symmetry in record time due to his relentless work ethic and the unique ability to take information he learns and make it his own. He too was inducted into the prestigious "Million Dollar Club" this past year, received the coveted SFG Leadership Award for his shining example, and in addition was recognized for helping create one of the fastest Regional Agency Managers, Deric Brock. Marlin has just begun to hit his stride and is already sought after by agents across the country and a regular fixture on stage at the Symmetry and Swat Training Events.

We left NO stone unturned and have provided a DETAILED step by step system to follow to ensure your success. All the experience, secrets, and sales techniques learned by Nate Auffort, Matt Smith & Brad Smith, Paul Huneycutt, & Marlin Faulkner, will be shared and taught to you in the 10 Steps. The question is NOT whether they work or not, that has ALREADY been PROVEN, but whether YOU are willing to learn, study, and master the skills necessary to accomplish the task set before you. All the hopes, dreams, effort put forth, and wishes, really only amount to one thing in the end, and that is RESULTS.

[/memb_hide_from]10 Steps on the Staircase to Success

The following are the 10 steps on the staircase to success that will be outlined in detail.

Step 1: SYSTEMS - Passwords, Logins, Agent Handbook & Getting Contracted with the Carriers

Setting up your Passwords and Logins with SFG:

Symmetry has 2 main websites: SFGLife.com (corporate website) and Optpro.sfgcrm.com (lead management website).

SFGlife:

You should have received your login for sfglife.com when your Unlicensed Agent Enrollment Form or Contracting Paperwork (if you were already licensed) was approved, from SFG. If you haven’t received it yet, please send an email to your mentor.

OPT! CRM:

You will be given your login for OPT from SFG, once you have submitted your license and your completed contracting paperwork has been approved. (This can be done by Clicking Here and selecting Pre-Contracting Steps)

Click to Below to Access each site:

Opt! Preferences:

Update:10/24/2016 Firefox is no longer a supported browser to use OPT! CRM

When using the Opt! site, it’s recommended you use Chrome, Internet Explorer 11 internet browsers and make sure to configure your browser settings in order to display the online portal properly. (note make sure you are currently using one of these 2 browsers to show the configuration options, you will get an error if you attempt to go to this link through Safari.)

Also, if you have technical difficulties, you may call OPT technical support team at 908-232-9968 to have them walk through it.

Getting Contracted with the Carriers & Carrier Contact Information:

Click on the buttons below to review Contracting procedures & Access Carrier Contact Information

Get your E & O Coverage:

Review the Symmetry Handbook :

- Mission Statement

- Code of Conduct

- Corporate Office Contact Info

- Authorized & Unauthorized Acts

- Commissions

- Contracting Procedures

- Important Terminology & Language

- Promotion Guidelines

- Levels of Leadership Chart

- Bonus Structure

- Contests & Trips

- Marketing & Branding

- Leads

- OPT! Lead Inventory

- New Business Submittal

- Agents Termination or Withdrawal

Step 2: LEADS - Ordering & Printing Off Your Leads

[memb_has_any_tag tagid=”267,269,271,390,442″]

Placing your First Lead Order:

- Have a Conversation with your Mentor/Manager: Its important to have a conversation with your Mentor/Manager about what kind of leads to purchase (5A leads, 4 A leads, etc.), how many leads, & what counties to purchase them from .

- Figure out How Much Money you Want to Make: The good news is, there is a science to this business, this is NOT a guessing game. You have the ability to buy your own production here, & print your own money.

- Watch the Unlocking the Combination to your Safe to Print your Own Money: To better understand the philosophy of how many leads to order

- Use the Combination to Your Safe Tool: Watch the video “What is the Combination” & then Click on the “Unlock my Safe Button” and enter in the combination

How Many Leads Should I Order?

Unlocking the Combination to your Safe to Print your Own Money:

Activity VS Productivity:

How many leads you get will greatly effect how many appointments you set. The number of appointments you set will greatly depend on how many people you get ahold of, which is greatly effected by the number of dials you make. Don’t be like many beginners and confuse ACTIVITY vs PRODUCTIVITY! You can be very “Active” yet accomplish nothing. You could spend hours organizing your leads, your paperclips on your desk, making sure you call at the right times, and worse yet, STOPPING after making a certain numbers of dials or contacts as opposed to continuing to do the ACTIVITY necessary to have the PRODUCTIVITY of setting the actual number of appointments needed to earn your desired income that week! You hold the combination to the amount of income you want to earn, Its your job to enter in the combination to the safe to unlock it.

If you haven’t done so already, make sure to print out “Outlining Your Success Worksheet” and send it to your manger or the person you are working with so that they can help game plan your success. You will need to consult with your mentor or manager on the amount of money you would like to make your first month, and they will provide you with the information on the number of leads you need to get, the number of contacts you need to make, and the number of appointments you will need to set in order to accomplish your monthly income goal. On average on the 5A, and 4A leads, for every 10 people you get a hold of, you should be able to set 1 to 2 appointments. So obviously if your goal is to set 10 appointments your first week out and you only get 40 5A leads, chances are very good you will NOT get a hold of all 40, and even if you did, the number of appointments you can expect to get would be 4-8. So again, make sure to have the number of resources “leads” to get the number of appointments you want. The combination WORKS every time, we just need you to tell us what’s in your safe, so we can show you how to unlock it. (use the Combination to Your Safe tool to figure out what you need to do to make the $$ you want.)

Combination to your Safe Tool:

Watch the What is My Combination Video, then Click on Unlock My Safe!

How To Order Leads in Opt-Soft

Click Below to:

PLEASE NOTE: Your lead order should be placed by Wednesday Night if you would like to receive your leads by Friday to begin calling to set appointments for the following week.

How to Print off your leads

[/memb_has_any_tag]

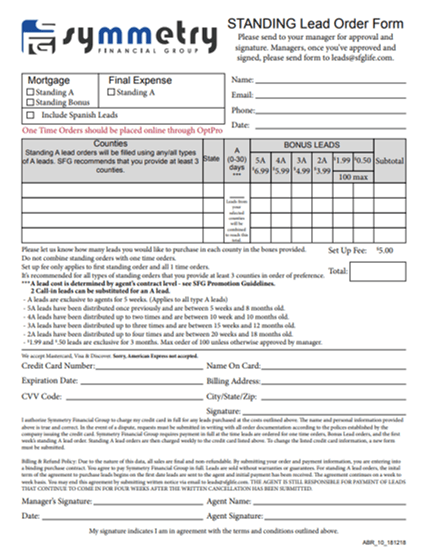

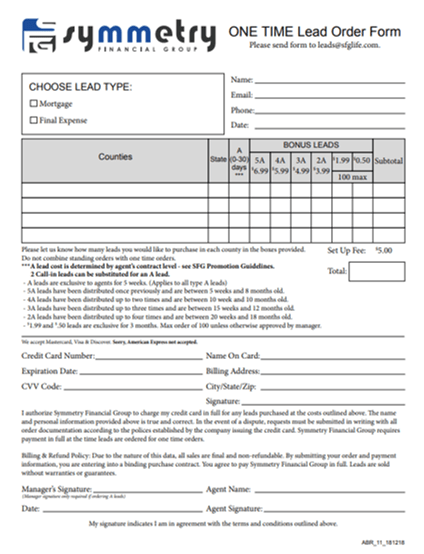

Once you Have Submitted Your 1st 3 Apps you Qualify to Order A Leads:

Once you have submitted more than 3 applications from the 5A, 4A, 3A, etc (referred to as B Leads) you will be able to submit a GMR/Standing A lead order (Geographical Mailing Request) for the number of A leads you would like to get each week in any particular county. This will require a Managers Approval. Please keep in mind when you turn in a GMR that you are AGREEING to put a credit card on file with the company to be charged each week for the number of leads you request. There is NO GUARANTEE that you will get exactly the number of leads you request each week, however they will mail and or call to fill your oder to the best of your ability. Please remember as you may already be aware, you are requesting mailer to go out with a GMR and it is Impossible to STOP mail once it has been sent out, so if you choose to STOP taking A leads in that particular county and want to TURN THEM OFF, you are RESPONSIBLE for paying for those leads that continue to come in for the next 4-6 weeks. Just because you have decided to TURN OFF your leads, doesn’t mean the company can STOP people form mailing back the letters that have already been mailed out for the last several weeks, or months.

(If you are in an area without bonus leads (5A leads, 4A leads, etc) you may be able to place your standing A lead order prior to submitting your 3 applications with approval from your manager)

Ordering A leads:

GMR/Standing A lead Order: (Geographical Mailing Request)

In order to get a steady flow of A leads coming in each week, you will need to submit a GMR/Standing A lead order after having a strategy session with your mentor/manager. All A lead orders MUST be approved by your upline manager. A leads can take up to 4-6 weeks to start coming in, HOWEVER be prepared for some instant A leads and or regular A lead mailers to start coming in immediately. This could happen for example if you submitted a GMR in a county where an agent before you had one on and just quit, we may have already been mailing there for several weeks or months with a steady flow of leads coming in. If this is the case, leads could start coming in the very next week. You will need to have your Manager email Pam Fair or the leads dept to check to see how many leads each of your requested counties could produce, are they mailing there already, and how quickly could you most likely start expecting your leads to come in. You can also purchase A leads directly though Opt! but they are scarce and only what is leftover each week from those who have on a Standing A lead order.

One Time A lead Order:

Blue List: There is what is referred to as a Blue List that your manager will get each week on Wednesday, after FIRST, all the A leads are distributed to those who have a GMR on file with the company. The Blue List leads are what are leftover or extra leads that came in above and beyond the GMR orders. These leads are first come first serve!! if your manager forwards you the list or calls you about them, you would need to ACT IMMEDIATLEY by emailing your manager that you would like those leads and in what counties. Those leads will then be assigned to you via your OPT Software and will need to be accepted and paid for by you when the next time you open up OPT and you are alerted you have new leads or you receive an email that new leads have been assigned to you. If you are assigned A leads by your manager and they are not accepted and paid for by Friday at 5pm EST then you will lose them.

Ordering A leads through OPT: If for some reason there are A leads still left over after all the GMRs are filled and the Blue List Goes out on Wednesday morning, you will see them in OPT ONLY from Friday after 1pm EST until Monday at 4pm EST. You will have the ability to go into OPT, Pay for them, and order them, which there is a normal 24 hour turn around to get those leads.

On some special occasions due to inventory or the inability to assign leads in OPT from your manager due to missed time requirements, you could be asked or required to fill out a One Time A lead Order which is below.

Below you will find the Standing A lead order form and the One Time A lead order form:

For an Extensive Explantation on All Questions that you may have about leads, please Click Here

Step 3: CALLING LEADS - Preparing to Call Your Leads

[memb_has_any_tag tagid=”267,269,271,390,442″]

Watch the First 90 Days:

[/memb_has_any_tag]

Which much due diligence and testing, we found that the BEST TIMES to call the forms/leads are on Fridays between 4:00-8:30 pm and on Saturday Mornings starting at 9:00am until you have the number of appointments that you need for the week. Also Saturday Evenings from 4-6pm, or as we like to call it Happy Hour Dialing, which can be a good time to get some more appts. If you still don’t have the number of appts you need by Saturday night, good calling times would be Sunday afternoon after 2:00pm, weekly mornings starting at 7:30am to about 10:00am and weekly evenings from 5 pm-8:30 pm. The most important thing to remember when it comes to appointment setting is to call as much as it takes to set the number of appointments that you need for that week!!

See the recommended schedule below for calling:

Friday Night 3:00pm – 8:30 pm ( You can call the leads that their ages are 65 or older or the leads that request call during the day even before 3pm )

Sat Morning 9:00 am – 1:00 or 2:00 pm

Sat Evening 3:00 pm – 7:00 pm (Happy Hour Dialing)

Sunday Afternoon 2:00pm – 6:00 pm (if needed to get the number of appts you need for the week)

** IMPORTANT- Listen to the following 2 Audios PRIOR to Calling your leads:

Below are the Audios that are under the Getting Started Section that we included for you to listen to again:

Print ALL the forms below to have with you when calling your leads:

You will send your activity report to your manager each week after calling.

(you will need to have BOTH the A lead Script and B lead Scripts when calling the B leads/Older Leads)

Set up another phone number to dial from for Free:

As referred to in the “Getting Ready to Call Your Leads Audio.”

Getting an additional phone number to call from that can be

integrated for free on your smartphone is probably hands down

one of the best things you could do to reach more people.

Click Here to learn how to setup a FREE in state or out of state

phone number to assist in calling your leads with Google Voice,

Step 4: APPOINTMENTS - Consult With Your Mentor or Manager About Your Appointments/ Using the online Product Guide

[memb_has_any_tag tagid=”267,269,271,390,442″]

I Got My Appointments:

[/memb_has_any_tag]

Agents who are new or have submitted less than 10 applications:

Which Product is right for my client?

- Organize your appointments you set with the lead on top and the Client Qualification form underneath. Example of how that looks (Click Here)

- Email your appointments to the person you are working with, who will then put their recommendations on the form and forward them to their upline key leaders and managers.(check with your manager to see if they participate in doing a Saturday call to go over your appointments for the week. (Currently Mangers who are doing those calls are the Auffort, Faulkner,Brock, Rudick, & Page Agencies on Saturday’s at 3pm CST Auffort 641-715-3670 pin 128443# Faulkner/Brock/Rudick/Page, Please call to get you dial in number.)

- When you have been instructed on which products would be the best for your clients, either by the phone call or email, put together some quotes for each of the carriers to have options for the clients as outlined in Step #4.

- Call the carrier underwriters and ask to do a risk assessment, or what I like to call a pre-approval, to make sure the client will qualify for that products that were recommended to you and get a tentative approval from the underwriter for each appointment PRIOR to going on the appt. Remember to ALWAYS write down the name of the underwriter you spoke to in the comments section of the application.

- If you are in the home and you uncover any other additional health information that differs, or is in addition to what you originally spoke to your mentor or underwriter about, call the carrier if they are open, to do another risk assessment to see if the client still qualifies for that particular product. If the carrier is not open, call your mentor or agency manager before writing the application to make sure it’s the best product for the client or if you would need to go a different route. (it would be a good idea even after getting off the phone with the underwriter to confirm with your mentor if this would still be the best route to go. Also keep in mind UHL will give you an tentative approval by a phone interview prior to leaving the house when you apply for the coverage.)

Although it may seem overwhelming in the beginning with the amount of information you feel like you “NEED” to learn before calling your appointments, you will need to trust in the system that your mentor or manager will provide you with the correct product or products to fit your client’s needs. In reality there is not much else for you to worry about or to learn but to take your qualification form and your lead and email it to the person that you are directly working with.

The person you are working with will then use the product guide below to assist in figuring out what are the 3 best options for your client. They will then write the 3 best options, in their opinion, on the top of the form and email it to the manager who will either get back with you by phone or email or if you are part of the Auffort, Faulkner, or Brock Agencies, you will get on a call on Saturday at 3 pm Central (request the # that you will be calling in on from your manager.) to go over those appts and get the recommendation of which product to present to the client and why.

[memb_has_any_tag tagid=”267,269,271,390,442″]

Below you will find an audio of how the call will go on Saturday.

Preparing to get on the call to go over your appointments

[/memb_has_any_tag]

Proceed ONLY If you have submitted 10 applications or more:

Which Product is right for my client and for my Agent’s Clients?

- Reference the Product Guide to see the top 3 products your client qualifies for each of your appointments and for each of your agent’s appointments.

- Email you and your agents leads, qualification forms, and recommended products to your mentor/manger for their review. If you are part of an agency doing calls on Saturdays at 3 pm CST, make sure the qualification form and leads are emailed to the manager or mentor an HOUR PRIOR to the call. (Currently Mangers who are doing those calls are the Auffort, Faulkner, and Brock Agencies on Saturday’s at 3pm CST Auffort 641-715-3670 pin 128443# Faulkner/Brock 641-715-3610 pin 884180)

- When you have confirmed which products would be the best for your clients, put together some quotes for each of the carriers to have options for the clients. At this point you should contact your upline to see if you qualify to have access to some more advanced training on “Getting Prepared for your Appointments”

- Call the carrier underwriters and ask to do a risk assessment to make sure the client will qualify for that products that were recommended to you and get a tentative approval from the underwriter for each appointment PRIOR to going on the appt. Remember to ALWAYS write down the name of the underwriter you spoke to in the comments section of the application.

- If you are in the home and you uncover any other additional health information that differs or is in addition to what you originally spoke to your mentor or underwriter about, call the carrier if they are open, to do another risk assessment to see if the client still qualifies for that particular product. If the carrier is not open, go back to the Product Guide and add the additional health information to see if that disqualifies the client from the product you planned on going with. If it does, than you can see what other products they would qualify for based on the additional information you collected and do another quick risk assessment if the carrier is still open. Call your mentor or agency manager if you run into any trouble. Depending on how long you have been doing this and based on how many applications you have written yourself, you will also be helping agents in your organization that are in the home who need your help. (keep in mind UHL will give you an tentative approval by a phone interview prior to leaving the house when you apply for the coverage.)

Online Product Guide & How to use it:

You will need approval by your Manager to have access to the Online Product Guide once you are qualified to use it.

The Online Product Guide is a game changer and was designed by and is exclusive to the SWAT Team Only ! We have taken the thousands of pages of underwriting guidelines, height and weight charts, medications, illnesses, and multitudes of different variables that may determine wether someone qualifies for one or more of the main carriers we represent, and have condensed it into an INSTANT online guide that will literally tell you which and what products your client will qualify for, within seconds!

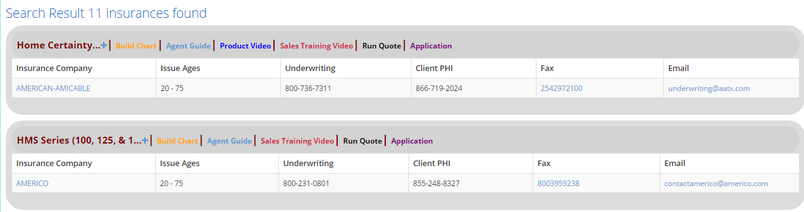

Once you have submitted 10 applications or more, when your appointments have been set, the first step will be entering your client’s health information into the Product Guide to see what products they qualify for. The products will be listed in products available for your client that they should qualify. (see example below). For instance a 45/yr old man that is 6 Ft 0 inches and weighs 220, with no health issues will produce a result with UHL 20 yr rop, UHL 20/30 Term, American Amicable Home Certainty, NLG/LSW Term, NLG/LSW Provider, NLG/LSW Standard Express, HMS 100/125/150, MOO Term Express, etc. etc. etc. in that order or similar. This does NOT mean that UHL 20 yr rop is the BEST product for your client and or their situation, what it DOES mean is that they should qualify for all those particular products with those particular carriers. It is up to you to utilize your experience and your mentor/manager ot choose which product, or products will be the best to present for each individual case. You will also do this for any new agents you are bringing on board or working with and then email them to your Key Leader/Manager, if you are not one already.

Once your mentor/manager receives your appointments, they will either e-mail, call you with the appropriate product to enroll your client on, or if you are part of the Auffort, Faulkner, or Brock Agencies, you will get on a call on Saturday at 3 pm Central to go over those appts and get the recommendation of which product to present to the client and why. Once you have received this information from your mentor, you will be able to reference additional information about that product on the Product Guide page in the search results (see image below). You can click “Sales Training Video” on the product guide as well to learn how you will present that product to the client. There are also links to print the applications and run quotes.

Request access to Product Guide by creating an account ONLY after you have submitted more than 10 applications

Under type of agent, select “Sales Agent”. Under the manager tab, select your nearest upline manager. If you are unsure of who this is, please ask the agent that referred you to Symmetry. Once you create an account, your manager will get an email letting him know you’re requesting access. Once he approves you, you will be able to login and access the site.

Make sure to watch the Sales Training Video below BEFORE asking your mentor for additional help, as unfortunately many of the questions we get as mentors and managers are outlined and answered in the video tutorials we spend hours putting together for you. As in Football, the coaches job is NOT to teach the players the game, what a football is, why sometimes you only get 1 point vs 3 points for kicking the ball through the same yellow posts, or why is that if you have 4 downs most of the time the team only uses 3 and kicks the ball to the other team on the 4th, but in contrast, their job is to COACH and show the players what plays to run in a given situation, perfect their offense or defense, increase the accuracy of the execution of the plays they are running, and most importantly how to WIN the game!

How to Use the Online Product Guide:

Below you will find the agent guides to the main carriers that we utilize. You will also be able to access these on the Product Guide search page. When you are new, don’t waste too much time trying to understand all the details in the agent guides as you will begin to understand more on how to reference them once you begin writing your first 10-15 applications. They can be used to reference your appointments for the week in terms of the height / weight charts, and the illness and medications that would cause automatic declines etc. As you will hear on the call, when you go over your appointments with your mentor, the most effective way to ensure you are applying for the correct coverage for your client, once you are told the ‘go to product,’ is to do a risk assessment over the phone with that particular carrier. You can find the phone numbers to the carriers and their contact information on the Product Guide page or Click Here.

AGENT GUIDES USED TO CREATE THE ONLINE PRODUCT GUIDE AND FOR YOUR REFERENCE .

AGENT GUIDES

Home Certainty | UHL Term | UHL Whole Life/Final Expense | UHL Guaranteed Issued | Americo Term | Trans America Term | LSW National Life Group EIUL

Step 5: QUOTES - Download the Carrier Software & Creating Quotes

Quoting Software:

To download carrier software, login to your SFG Back office www.sfglife.com and click on the “Carriers” tab. FOLLOW ALL the directions to download the following software onto your computer. Below are the main carriers you will be using at first. You can click on each link which will direct you to the individual carrier pages with the software downloads, agent guides, marketing materials, and even training on how to use that particular software etc. (note: if you are using a Mac you can purchase Parallels Desktop ($79.99) or VM Fusion ($59.99) to run a windows version on your mac in order to download the quotes. These programs allow you to run both your Mac and Windows operating system simultaneously! If you do not have a current windows version you can buy that at the Microsoft Store Online and download that on your computer using your parallels desktop or VM Fusion desktop.)

Click each of the companies below to download their software:

United Home Life: Their software is web based & you will need to use the password USA to login. Click Here

![]() LSW/National Life Group – Prior to completing your contracting paperwork with LSW, please click here and fill out the form to get “Limited Access” to their back office to run quotes (please read further instructions on that page).

LSW/National Life Group – Prior to completing your contracting paperwork with LSW, please click here and fill out the form to get “Limited Access” to their back office to run quotes (please read further instructions on that page).

In the future, you will want to download the other software that is located in the software download section of the SFG site, but these will be the main 6 companies you will use in the beginning. (note: Home Protector’s name has been changed to Home Certainty but all instructions on the videos remain the same)

How To Run Quotes and Illustrations:

[memb_has_any_tag tagid=”267,269,271,390,442″]

The Science Behind Creating Quotes

[/memb_has_any_tag]

Examples of Running Quotes:

[memb_has_any_tag tagid=”267,269,271,390,442″]

Click and Print PDF Examples of Living Benefits, Cash Value, and Returns of Premiums:

[/memb_has_any_tag]

Mobile Quotes:

Utilize Our Mobile Quoting Tools:

Below you can click on the carrier to take you to their mobile quoting tool which can be accessed from your COMPUTER, TABLET or even your PHONE. Remember that these tools will NOT provide illustrations.

Accessing Mobile Quotes on your Smartphone:

If you are in the home or on the fly, and once you understand how to utilize the regular software, you can use the mobile quoting tool by going to agenttraining.info from your smart phone and clicking on the button called “Quotes”. American-Amicable will require you to put an agent number in to run the quotes, If you need an agent number to put in for AM AM, request to use the persons agent # you are working with. Thh other Carriers will Not require an agent number.

Step 6: APPLICATIONS - Printing and Filling Out Applications

How To Print Off Applications:

Your first application for EACH Carrier MUST be submitted on a paper App

Printing out your Applications for your first apps you write:

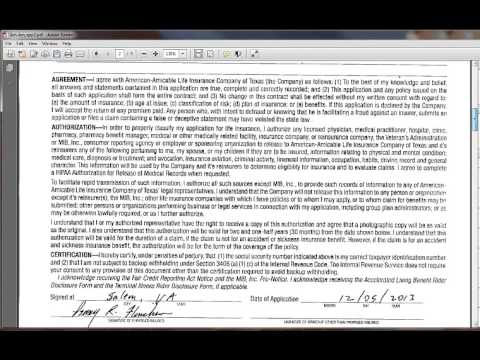

Once you have written your first piece of business with each individual carrier, you will be assigned a producer or agent number, which you will be able to use to call each individual carrier to order applications that will be mailed to you at no charge. You will also be able to use your agent or producer number to access e-apps for the majority of the carriers and certain products that they offer to submit electronically. For now, you’ll want to print off at least the American-Amicable Home Certainty app and the United Home Life Final expense (Whole Life) applications and practice filling them out as you follow the video tutorials below. Most of the applications are VERY similar when filling them out so this will give you a good idea of how to do it. (Please also print out the SAMPLE APPS to help guide you)

Almost all of the applications can be found by going to iPipeline (click on the print app button below), however American-Amicable has their own website to print their applications and Questionnaires. If it is your first time using ipipeline, you will need to create an account.

(if the Print Application button is not working for you, click here, login into your SFG Site, and select ipipeline at the bottom of the page. If the American Amicable application button is not working, click here and click under “For Standard Applications, for American -Amicable Applications. or try this click here. )

How to Fill Out Applications:

Watch both videos in their Entirety BEFORE using any of the Quick Reference Guides on Filing out Your Applications.

(note: Home Protector’s name has been changed to Home Certainty but all instructions on the videos remain the same)

Do NOT use the Quick Reference vids below until you have watched BOTH videos above.

Below are Quick 5-8 minute Quick Reference Videos on Filing Out Your Apps:

Print & View the Sample Apps:

Print off the sample apps by clicking on each application icon. You will want to use these apps to practice, and reference PRIOR to & while you are in the home, and to review and correct PRIOR to submitting your app to be scrubbed by your mentor/manager. You will have the ability to also page through the sample apps online, as they are in E-book Format.

ONLY PROCEED Once you Have Submitted your First Paper Application to the Carrier

Once you have submitted your first paper application to EACH INDIVIDUAL carrier, you now have several different ways of filling out applications:

3 Different Ways Applications are Most Commonly Submitted

- Use iGo to fill out an eApp online (MOST EFFECTIVE)

- Use iPad to fill out a PDF application (Recommend using “Notability” for iPad or “Squid” for Android)

- Paper Applications ( Old Fashioned way, but Required on your 1st application submitted to each individual carrier)

Submitting e-Apps:

Introduction on Using iGO e-Apps

Most of the companies we work with use electronic applications, which ensures the application is filled out correctly. They also get sent directly to the underwriters and cuts down on processing time by days. Watch the 4 quick 1 to 2 minute training videos below on how to fill out iGO e-Apps.

How To Fill Out a NLG/LSW iGo E-app

Most of the eApps are relatively similar so we’ll show you LSW/NLG as an example. Click the pic below to watch the quick training on how to fill out the LSW iGo e-app.

Accessing iGo eApps

You can get to the carrier e-apps by clicking here or on the menu bar click on Resources and iGO e-Apps. Or, Select the Carrier Below to Access their e-App

Using Your I-pad to Fill out Paper Applications:

If you use an iPad, you’ll get the applications the same way as you get your paper applicaitons, only instead of printing them off , just save them as a PDF document on your computer. We recommend you manage and organize them in a Dropbox or Google Drive folder to be able to access from your I-pad. . Watch the video below for more detailed instructions. Please note: the beginning of the videos show the old Symmetry Website, so you can use the links above to get to the application pages. Also, the “Home Protector” name has changed to “Home Certainty”.

Step 7: PRESENTATION - How To Present Full Mortgage Payoff, Critical Period Coverage, & Final Expense

Presenting Full / Partial Mortgage Payoff

(note: Home Protector’s name has been changed to Home Certainty but all instructions on the video remain the same)

Getting a 80% Close Ratio in the home

Presenting Critical Period Coverage

Critical Period Coverage Concepts:

Presenting Final Expense

Final expense insurance is an insurance policy used to pay for funeral services and a burial when the named insured dies. Such a policy helps ease the financial burden placed on a family when a loved one dies. Final expense insurance allows the named insured to feel safe knowing that funeral-related expenses are covered regardless of the statutes of their estate at the time of death.

Download the Final Expense – Phone Script

The Art of Selling Final Expense with Matt & Brad Smith

In Home Scripts

(click the button to access the script)

Step 8: PREPERATION - Preparing To Go Into the Home

Preparing to Go Into the Home:

- Have the necessary applications for your scheduled appointments and backups.

- Have your scripts printed out and studied on what you will say in the home

- Always remember to Create the Value and find out their WHY!

1. Have the necessary applications & backups for your scheduled Appts.

Before going into the home, you want to make sure that you are prepared with the necessary paperwork, not only for the appointments that you went over with your mentor, but also with back up applications in case the situation or product changes due to additional information the client gives you while you are in the home. There are a couple ways you can do this. 1. Go to an office supply store and pick up a expandable file folder or file box to keep in your car. You DON’T want to walk into the home carrying this with you of course, as you will look like a traveling salesman, which is NOT the first impression you want to give as you walk into a potential clients home. 2. Download all of the applications to an iPad using tehe app “Notability” (you can learn more about this option in Step 6 above).

Below are the applications you should have with you along with the questionnaires. If you do not have them printed out already, please do so now.

American Amicable:

Home Certainty | Easy Term | Dignity Solutions

AM AM Questionnaires (Print 5 of each of the main ones)

Diabetes | High Blood Pressure | Asthma | Arthritis | Cancer | Aviation | Alcohol Use – For someone with a recent DUI or DWI

United Home Life:

Term Life | Final Expense/Whole Life | Provider Whole Life

Americo:,

HMS 150 | Critical Illness Rider App | Critical Illness Disclosure Disability Rider App | Replacement form -required in almost ALL states whether replacing current coverage or not

(if the links to the applications for UHL or Americo do not work above for you, click here, login into your SFG Site, and select ipipeline at the bottom of the page. If the American Amicable links aren’t working for you, click here. login to your SFG site and click under “For Standard Applications, for American -Amicable Applications under Carriers/American Amicable. or try this click here. )

2. Have your scripts printed out and studied on what you will say in the home:

The following scripts are the scripts you want to make sure to print out, study, and take with you, as this is your guide to how the presentation will go in the home. In the beginning, many agents have the scripts right in front of them (hidden behind their computer in in their presentation folder) to reference and make sure to stay on track. Print off the following scripts to study and take with you.

3. Always remember to create the VALUE and find out their WHY?

Now that you are prepared to go into the home, remember that you are there to address a need that your client is or was concerned about. It’s best if you go in with the mindset that you are NOT there to SELL anything, but rather to find out what their concern is for wanting to put coverage in place to protect their family, and helping them to customize the coverage that best fits their needs and fits into the budget.

Message from Agency Director Nate Auffort: “I will tell you, as I tell everyone of my clients, “budget” is a loaded word, as we all budget for things WE see VALUE in. Some people budget $150/mo for a cell phone or $100/mo to watch tv, while others may think $150/mo for a cell phone is crazy, yet those same people may budget $500/mo to go out to eat or even on alcohol. I have made the mistake before, so I am not going to do it again, in terms of determining what VALUE you place on the protection of you and your family or even the value you place on your wife or families life, but rather present all the options you qualify for and then allow YOU to customize the coverage that best fits YOUR needs and what VALUE you see in it.”

We cannot stress enough that the MAJOR area that most agents fail to do well in the beginning is to REALLY find out and PULL OUT the clients Why. WHY did they fill out this form? WHAT was there concern? Example, “HOW would it look for you (fill in their name) if we were having this conversation without (fill in their spouses name) here, and they had passed away yesterday? Would it be tough financially for you to stay in the home or to keep the house?” Would it be somewhat of a financial hardship on you? Most of the time that answer is an astounding YES! “WELL (fill in their name) what would you have to do in order not to lose your home?” And if your home, or a portion of your home was paid off, or even if the mortgage payments were mad for you for a set period of time allowing you enough time to make Logical decisions vs emotional decisions, how would that effect your situation in the event of your spouses death?

Let them answer, and paint the picture of what their life would look like WITH this product in place and more importantly what it may look like WITHOUT!

Listen to the following audio before going into the home to learn how to create the value!

Step 9: SUBMISSION - Submitting Your Completed Applications to The Carrier

Steps to Submitting your Business:

- Print out or view the sample application that corresponds with the paper application you wrote.

- Go line by line and SCRUB your app (look for any missed boxes or mistakes) and correct them.

- Double check the application again, send it to the person you are directly working with to look over.

- Once the person you are working with has approved it for submission, create the transmittal page & Upload the application by Clicking on the UPLOAD button below.

- Finish Submitting the Application by clicking the Blue SUBMIT button below on this site & complete the Submission.

- When the app has been approved or rejected by the manager, you will receive an email confirmation.

- When you have submitted your last application for the week and PRIOR to 5pm on Friday, Fill out the Weekly Report;

Utilize the Sample Apps to scrub your application:

How to Upload and Submit your Completed Application:

Watch the video below to learn how to create your “transmittal page” and upload your application. After BOTH you and the person you are working with have Scrubbed your Application, you will then enter the application into OPT. It will be forwarded to your Manager who will either approve or reject your application submission. It is important to understand that it is NOT the job of the manager to SCRUB your app, but the job of YOU and YOUR MENOTR to make sure the application is filled out correctly before submitting it in OPT. Once your manager receives the application, if for whatever reason they have a chance to triple check it and finds any mistakes, and they”reject it” and it will be sent back to you for correcting the mistakes. If the application is in good order, your manager will approve it and the application will simultaneously be submitted to Symmetry and to the Insurance Carrier. You will receive an email confirmation that it has been approved by your manager. If for whatever reason you do not see this within 24-48 hours, please reach out to your mentor to bring it to your managers attention. It is VERY important to watch the video tutorial BEFORE submitting your applications.

Doc Scanners for your mobile phone:

If you are writing your applications with paper and pen and don’t have a scanner, we recommend using one of the smart phone apps below, which will allow you to take pictures of each page and merge the images into one pdf document. It will also lighten the images so they aren’t dark. If they are dark, often times the carrier will not accept them.

Upload & Submit Your App:

After you have viewed the video and are ready to submit your application, click the upload button to upload to Opt and the submit button below to submit on agenttraining.info

Fill in the Weekly Report:

Please fill in your weekly numbers by Friday at 5pm. DO NOT put anything in the PPL Column as the spreadsheet as it will automatically calculate it for you. If your name is NOT on the list you can type it in. Also MAKE SURE you are entering in your numbers on the correct week, which for example, the month and date listed at the bottom is the date of the Friday of each turn in. Watch the short instructional video on how to update the weekly report.

Find Your Manager & Click to Enter in your Weekly Numbers:

Step 10: COMPLETION - Getting Paid On Your Business

Congratulations on submitting your application to the carrier. This is just the first step in getting this policy issued so don’t forget to continually check the status of the applications to make sure everything goes through smoothly. Occasionally the carriers will have outstanding requirements that you may need to get to them in order to get your application issued in a timely manner.

It really is amazing that agents will go through all the hard work of getting licensed, buying leads, learning how to get good on the phone in order to book the appointment, go over with their mentor on which product suits the client the best, drive to the clients house, sit with the client, fill out the paperwork, collect the voided check, make sure the app is filled out correctly by watching the videos and comparing it to the sample apps, submitting the app, and  then……..NOTHING…..moving on to their next appointment while disregarding the very applications they just spent so much time and hard work to get!!! They just let the application sit there, at the carrier, not getting approved or issued, and in effect, not getting paid!!

then……..NOTHING…..moving on to their next appointment while disregarding the very applications they just spent so much time and hard work to get!!! They just let the application sit there, at the carrier, not getting approved or issued, and in effect, not getting paid!!

Could you imagine a farmer doing all the hard work of clearing the field, removing the weeds, tilling the ground, planting the apple seeds, watering the seeds, keeping the bugs away, and then come harvest time, when it is time to reap the rewards of all their hard work, the farmer decides to go out and clear a different field, pull different weeds, and plant different seeds while he lets all the trees with fresh apples grown on them fall to the ground and rot! That would be the STUPIDEST thing in the world for a farmer to do, wouldn’t it?! After his first season he would be OUT of business and bankrupt. Unfortunately, many agents run their business just like the example of the farmer who ignores his harvest. Allowing your business to “sit” at the carriers without checking it, calling the carriers, or getting the necessary outstanding requirements, is as detrimental to your business as the example of the farmer, and quite frankly just as STUPID!

I believe all of our goals in this business revolve around 2 major things, helping families protect their loved ones, and increasing our financial situation in life to provide for our loved ones. Either way, not following up and getting your business issued accomplishes neither goal. By now you should have realized that you are an independent agent and that your income is reliant on you and you alone. The key difference between a profitable agent and one who quits and goes back and gets a job, working for someone else that understands the philosophy of profit, is the ability to turn your applications into issued policies.

As the majority of the carriers follow similar processes in terms of getting paid direct DAILY deposit into your bank account, usually between 3-5 days of your business being submitted National Life Group’s process for getting paid is slightly different and they only pay once a week.

Please click to view National Life Group’s unique process:

Unlike the other carriers LSW will NOT draft the premium until the application is APPROVED and then ISSUED. Keep in mind that if they are healthy that the auto underwriter could approve the case within 12 -24 hrs, so tell the client when applying that they could see the draft come out anywhere between the next 2 to 3 days to 2 to 3 weeks.

Submitting the Policy Receipts:

Once the policy for your client has been approved, issued, and mailed to you, you will need to schedule a time to deliver the policy to them. With the policy, will be included a policy receipt and any amendment that may be required from the carrier. The policy must be signed by the client when you deliver the policy. This is a very important part of the process to ensure that the policy has been delivered and accepted by the client. In some cases with certain carriers, if these policy receipts are not received in 60 to 90 days, they will actually cancel out the policy and chargeback the commissions. You WILL be notified by email and or a letter in the mail before this would happen. Also if you have an amendment that needs to be signed, you will not get paid until the carrier receives it back. You can click below on the carrier contact button to locate the email to send in your policy receipts or instructions for each carrier on where to send the policy receipts will be outlined with the policy receipt when you receive it.

click above button to get email address to where to submit your policy receipts

Getting Paid on Your Business:

Listen to the following 3 Audios:

How To Get Paid Quickly on Your Applications:

Although the video only covered how to check your pending business with American-Amicable, United Home Life, Transamerica, and Americo. If you submitted business with another carrier, don’t worry. They’re all very similar and if you watched this tutorial you should be able to figure it out. If not, you can always call the carrier directly for specific instructions.